THE Belief3 RUSSIA INDEX

The war in Ukraine resulted in over 1,000 companies leaving or curtailing operations in Russia. Yale’s CELI tracks those companies and the list is impressive. But what happens after the war? Someday, the Russian market will reopen. Can we help build a better Russia and prevent these types of disasters in the future? Can the return of Western companies to Russia provide a close-knit integration that would prevent a future war?

It has been roughly 6 months since Veriphix extracted data out of Russia and we are curious to see what has changed.

Veriphix’s Belief3 Russian Index focuses the award winning Veriphix technology on the Russian market to anticipate the end of the war and help companies plan for reintroduction of products and services. For the next 3 weeks, we will be looking at the Russian market to get a better appreciation for what is in the mind of the Russian population.

THE Belief3 RUSSIA INDEX / WEEK 4

The Russian population is moving into a War mentality.

Last week in the news:

Biden visits Canada.

Zelensky invites Xi to visit Ukraine.

Protests continue in France.

Coinciding with Russia assuming the UN Security Council Presidency, Putin has successfully moved his population into a War mindset.

The Russian population appears primed for a brutal Spring. While a “special operation” is an administrative act that does not impugn the character of the average Russian, a War does. By focusing the special operation and providing a focus (i.e., Mariupol), the Russian population can compare the perceived potential gain with the loss. This has caused increased concern over the economy, especially in those over 35.

The data for week 4 was collected March 30th, 2023 after Biden’s visit to Canada and after Zelensky invited Xi to join him in Ukraine. We saw President Biden’s visit take its toll on the Russian view of future relations with Canada (-1.99%).

All is not well, though, for Russia. This Spring, communal assessments are reset, prices continue to rise, and Spring/Summer weather means increased fighting will require even more sacrifice from the Russian public.

This concludes our four-week Russian Index preview. But for Western Brands, understanding the viability and timing of a return to Russia is just getting started.

Here are two comments pulled last week from Russians regarding the end of the war.

“The main phase may end”

“There are no decisive steps of the world community, and then the Russian government will have nothing to justify the poverty of the people in a rich country.”

Though our public preview ended, the complete ongoing index is available to our vetted subscribers.

Click here to join the companies that receive these weekly insights.

THE Belief3 RUSSIA INDEX / WEEK 3

Putin shows he still dominates the world of influence, which is bad for Western brands.

Last week in the news:

Putin visits Ukraine.

Xi visits Russia.

Protests in France.

Russia’s dominance in the influence realm was on display this week as it implemented a nearly flawless PR push that advanced Russian interests and negatively impacted Western Brands.

Putin’s trip to Mariupol focused the “special operation” by giving him a tangible example of Russians being liberated in Ukraine. Visiting a new apartment may have looked overly staged to westerners, but inside Russia it helped define the purpose of the “special operation” and show that progress was being made. The nationalism interjected into the Russian media by the visit helped drive down the likelihood of domestic protests (-2.37%) and fear over terrorism (-1.28%).

The protests in France, fomented by a Russian influence operation distributed via social media, helped undermine the view of Western prosperity. This, timed with the visit by Xi, allowed Putin to turn his nation’s attention from the West to the East. If this larger influence operation continues to be successful, companies entering Russia post-War will need to address a Russian population biased against the west.

A third pivot occurred this week which may help resolve the War, but not on Ukraine’s terms. In addition to providing a focus for the “special operation” and showing progress (e.g., a visit to a new apartment), an additional issue has been interjected into resolution and that is “worldwide opinion.” Rather than reject outside opinion, Russia has pivoted to embracing it, but with a wider definition of outside that includes China. Resolution is no longer seen as a Ukraine-Russia issue or even a West issue (e.g., US support), but a worldwide solution. This is a master class in hijacking a narrative and using the opponent’s issue to achieve your own goals.

One more week in Russia before we leave. What will Week 4 have in store for us?

THE Belief3 RUSSIA INDEX / WEEK 2

Week 2 of the Belief3 Russia index captured the impact of:

The Kyiv Independent reported that Russian enlistment offices have begun sending summons to men in 6 regions.

The downing of the US drone by Russia.

The US bailout of SVB and associated banking crisis in the EU.

By tracking how belief changes each week across 15 different issues, we are able to see the belief landscape of the Russian population.

AGE MATTERS

One of the features of Belief3 is the ability to track belief change in specific demographics. Belief3 identified that the news impacted Russia’s under 35 segment differently than it did the over 35 segment. One of the Russia Index questions relates to use of nuclear weapons. Although there was no statistically significant change this week, there was a change in how the under 35 and over 35 demographics reacted. The under 35s went from having no responses over 50% last week to having a number over 50% indicating their fear that nuclear weapons will be used.

So why is the under 35 group reacting differently? That group was born in 1988 or later. The USSR dissolved in 1991, which means this under 35 segment really only knows Russia and not the previous USSR experience. The under 35s generally have little to no experience with the threat of nuclear war. It is an analogous issue to the U.S.’s generation Z. This is a group that has grown up with the Internet and in a different geopolitical environment.

Russia is essentially a country of two very different populations:

Over 35s and under 35s.

NUCLEAR WAR

Last year, Palantir’s CEO Mr. Karp was on TV warning the world that there was a 25% chance of nuclear war. Veriphix just happened to also be monitoring that issue when Palantir was all over the media. The 25% forecast was not wrong, but it missed the point. Humans do not perceive probabilities linearly. We lose fidelity at the ends. You are much better at distinguishing the difference between 50% and 55% than you are 0% and 5% or 95% and 100%.

The current likelihood of nuclear weapons being used is 15.64%. Last week it was 16.38%. It actually went down this week, but we call any movement of 1% to be neutral. It has been hovering at this level for the past 6 months. The important part is that the chance of nuclear weapons being used has gone down from 25% last year.

But if you just look at the probability you would miss the larger picture. Belief3 extract nudges (content indicators) that change belief. That helps us get to the why.

So what is actually happening?

Russians believe that certain events will need to happen BEFORE nuclear weapons are used. Russians believe they have advanced technologies such as hypersonic weapons. Knowing that use of nuclear weapons will result in Russian suicide (i.e., weapon of last resort), they do not see nuclear as a real possibility. But this is also where age (above) comes back into play. The over 35 demographic watched the dissolution of the USSR happen in which no nuclear weapons were used. The under 35s do not have that experience. Putin’s “special operation” into Ukraine evokes different belief structures in these two groups as a result of their different life experiences.

What will week 3 reveal?

We don’t know but Putin’s visit to Mariupol is sure to have an impact. How will it impact the Russian population? Tune in for week 3.

RUSSIA INDEX / WEEK 1

STATE OF THE RUSSIAN ECONOMY

The Russian population is experiencing the economic pain of war and beginning to long for Western goods. The hoped for replacements have not materialized and a malaise is sinking in. As one panel member explained: Those who could go abroad went and those who remained are intimidated and weak.

The inflationary impact of the war has been incorporated into the Russian economic outlook on consumer expenses which are seen as increasing, but not as badly as 6 months ago (60.6%, -6.35%). Unemployment improving is now approximately neutral with considerable improvement from 6 months ago (48.31%, +6.29%). Unemployment is an interesting issue as the increased optimism is caused in part by the mobilizations and exodus of people. The loss of foreign companies from the Russian market is seen as having a direct impact on unemployment. For this reason, the return of foreign companies in the post-war environment will likely be welcomed.

VIEW OF WESTERN COMPANIES

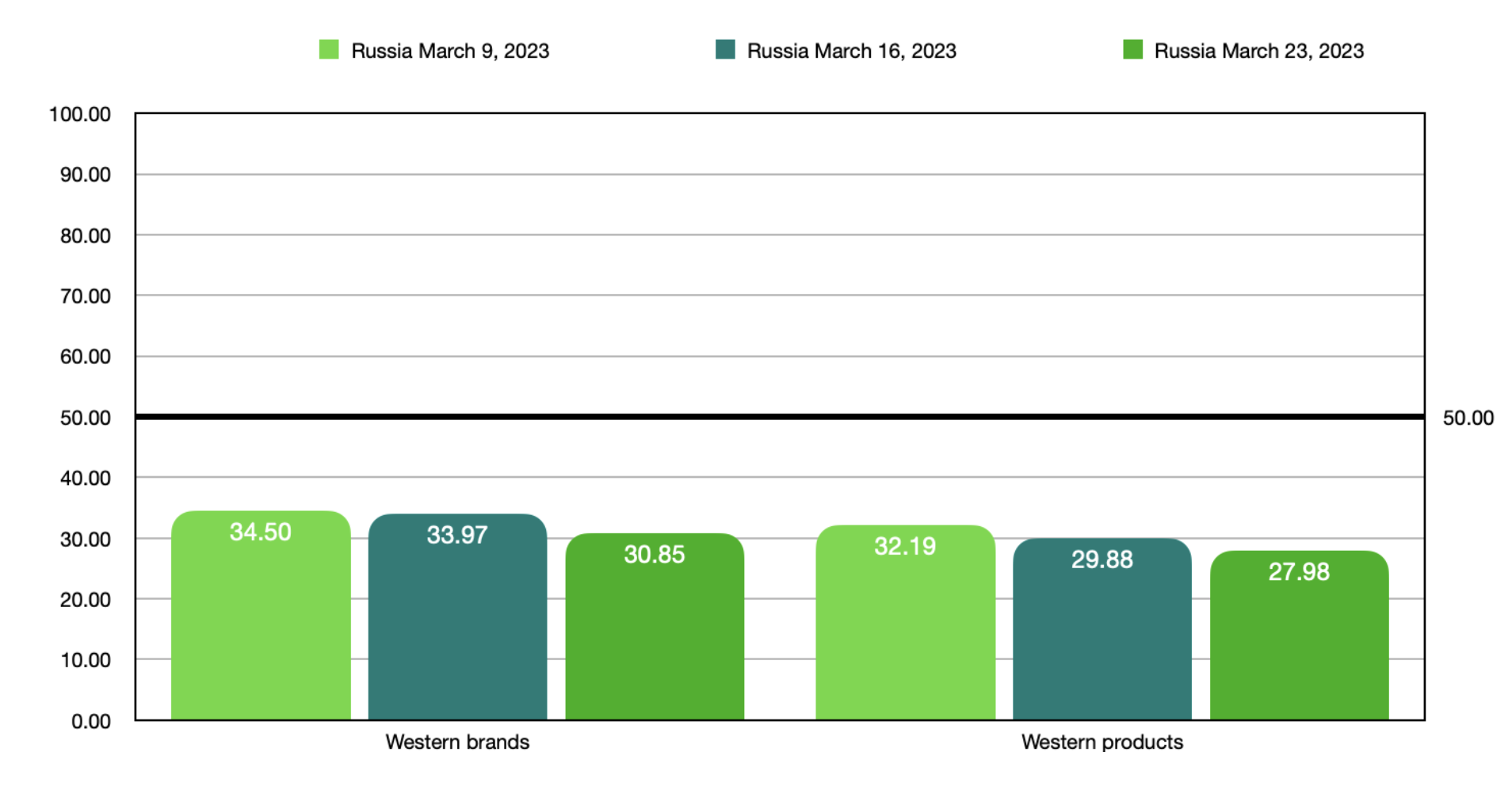

The Russian population is eager for the return of Western goods. Russians, while still pessimistic, have increased their belief that Western brands will return in 6 months (34.5%, +3.05%) and their belief that Russians will purchase the Western products (32.19%, +5.24%).

Russians are not rejecting Western companies, but feel those companies have abandoned them. There is concern that Western companies have already found replacement consumers and lost interest in the Russian market. China is seen as that replacement.

HOW TO MESSAGE INTO RUSSIA WHILE YOU ARE WAITING

First, let’s hope the wait will not be very long. Our data is showing some positive trends in regard to the war ending soon. But while you are waiting, deemphasizing investment or business with China will let the Russian population know you plan to return when allowed.

Remember, this was a “Special Operation” and not a War chosen by the Russian people. While it may have escalated into a War, in the belief system of the Russian population this was not two populations going to War. Providing those left inside Russia with hope for a future may very well be the best thing your company can do to help end the War.